Saeed Ghasseminejad | August 7, 2025

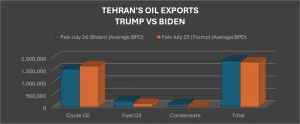

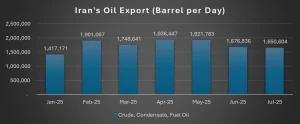

The data show that Tehran managed to export 1.65 mbpd of crude, condensate, and fuel oil in July 2025 — almost identical to the July 2024 exports number. In total, between February and July 2025, Iran exported an average of 1.8 mbpd of crude, condensate, and fuel oil. For the same period in 2024, under the Biden administration, Iran exported an average of 1.85 mbpd.

Iran’s Oil Exports Benefit Primarily China

Ninety-five percent of the exports in July 2025 went to China, according to TankerTrackers. The other 5 percent went to the United Arab Emirates. Ports such as Ningbo in China and Fujairah and Jebel Ali in the United Arab Emirates were on the receiving end of the Iranian crude, condensate, and fuel oil. Forty-four percent of the total volume was transferred through 15 vessels with Iranian flags. Vessels from 11 other countries, such as Guyana and Brazil, have been involved in transferring the rest of the oil.

Iran’s Oil Exports in 2024 Reached a New High

According to the Organization of the Petroleum Exporting Countries (OPEC), Tehran’s oil export income in 2024 reached its highest level since 2019. In 2024, Tehran exported $46.7 billion worth of crude oil, $5.6 billion more than in 2023. The number is in line with, but slightly higher than, our estimate at the Foundation for Defense of Democracies, $41 billion to 45.5 billion, which considers the discount that Tehran has been reportedly offering to its main customer, China, to incentivize Beijing to buy its sanctioned oil. We estimate that so far in 2025, Tehran has exported up to $27 billion of oil.

Congressional Efforts to Enforce Sanctions

The Biden administration’s inability or unwillingness to enforce U.S. sanctions against Tehran’s oil export operation was a source of tensions between the White House and the U.S. Congress. In an attempt to force Biden’s hand, the House in 2023 passed the Stop Harboring Iranian Petroleum Act (SHIP) Act, which would both expand the administration’s punitive tools to enforce sanctions and introduce mandatory reporting to increase Congress’s visibility into the administration’s enforcement efforts. However, the Senate failed to pass the bill.

Washington Should Sharpen Its Sanctions

Iran uses the money it gains from oil exports to fund repression at home and aggression abroad. If the exports continue, Iran will have the money it needs to rebuild and expand its nuclear program, missile arsenal, and proxy groups.

To effectively cripple Iran’s illicit oil trade, the United States must change its approach. The current sanctions are too timid, avoiding major banks and ports in places like China and the United Arab Emirates, which are known hubs for this activity. A tougher stance is needed, starting with sanctioning not just the companies involved but also the people who run them, from the C-suite to the board of directors.

At the same time, the United States should move beyond sanctions alone and use its military and intelligence capabilities more forcefully. This means increasing the U.S. Navy’s interception of Iranian oil tankers and running clandestine operations against top offenders to send a clear message: The cost of helping Iran has skyrocketed.

Saeed Ghasseminejad is a senior Iran and financial economics advisor at the Foundation for Defense of Democracies (FDD). For more analysis from the authors and FDD, please subscribe HERE. Follow Saeed on X @SGhasseminejad. Follow FDD on X @FDD and @FDD_Iran. FDD is a Washington, DC-based, nonpartisan research institute focusing on foreign policy and national security.

Leave a Reply

You must be logged in to post a comment.